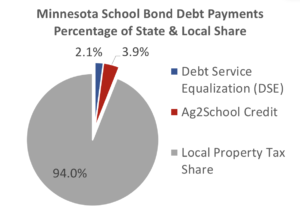

Minnesota’s new Ag2School 40 percent tax credit has nearly tripled the state share of school district debt service payments to 6 percent from 2017 to 2018. The distribution of the state share also has weighted more to rural school districts. Still, 94 percent of the $938 million in school district debt service payments are paid by local property taxpayers this year. View interactive map by school district

State Share Triples

In 2018, the first year of the program, the state will provide $36.6 million in aid through the Ag2School 40 percent credit for taxes on agricultural land and private timber land.

Debt Service Equalization (DSE) provides $19.9 million for a total of $56.6 million. This state share is dwarfed by the $881.9 million in local property taxes for school bond payments.

| State & Local Share of School Building Bond Payments for Taxes Paid in 2018 | |||||

| School District Fund 7 Debt Payments minus State Share = Net Local Levies | |||||

| Statewide and Regional Summaries | Fund 7 Debt Payments Eligible for DSE or Ag Credit | Total Debt Service Equalization (DSE) Aid | Debt Service Levy Net DSE Aid | Estimated Ag2School Ag Credit | Local Property Tax Share of Debt Payments Net State Share |

| Statewide | $938,496,907 | $19,948,057 | $918,548,851 | $36,642,345 | $881,906,505 |

| Metro (7 County metro plus districts >7,500 pupils) |

$535,803,463 | $6,276,292 | $529,527,171 | $3,471,132 | $526,056,039 |

| Rural (Greater MN districts <7,500 pupils) |

$402,693,444 | $13,671,765 | $389,021,679 | $33,171,213 | $355,850,466 |

With the addition of the Ag2School, the state share of school building bond payments grew from 2.1 percent to 6 percent.

With the addition of the Ag2School, the state share of school building bond payments grew from 2.1 percent to 6 percent.

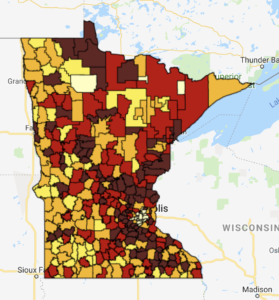

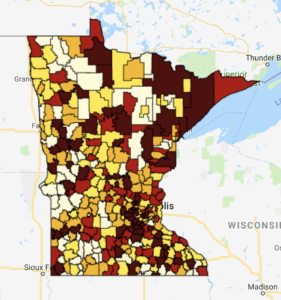

More state aid for school bonds is distributed in rural school districts as compared to metro1 districts due to the predominance of ag and timber land in rural Minnesota and lower property values per pupil in exurban areas around the Twin Cities. The state share of school bond payments in rural Minnesota is 11.6 percent as compared to metro’s 1.8 percent.

| Percentage of State Share of Debt Payments | |||

| Statewide and Regional Summaries | DSE of Debt Payments |

Ag2School Credit of Debt Payments |

State share of SD Fund 7 Debt Payments |

| Statewide | 2.1% | 3.9% | 6.0% |

| Metro (7 County metro plus districts >7,500 pupils) |

1.2% | 0.6% | 1.8% |

| Rural (Greater MN districts <7,500 pupils) |

3.4% | 8.2% | 11.6% |

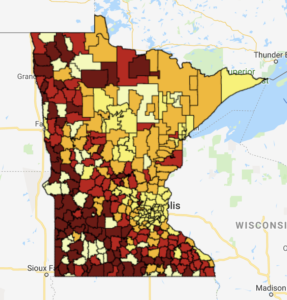

In the map, the distribution of state aid to rural district farmers through the Ag2School 40 percent tax credit can be clearly seen.

The median district state share is 11.1 percent when combining Ag2School and DSE. This occurs in Underwood.

The median district state share is 11.1 percent when combining Ag2School and DSE. This occurs in Underwood.- A total of 43 districts have no debt payments so they are ineligible for any state share.

- Only 34 districts receive Debt Service Equalization, which lowers tax burdens for all classifications of property owners including commercial and homeowners.

- A total of 277 districts’ farmers receive a 40 percent credit on their taxes through Ag2School. No other classifications benefit, and they are not affected at all.

Ag2School

Farmers and private timber land owners in 277 Minnesota school districts benefit directly from the Ag2School 40 percent credit towards their school district’s debt tax payments.

In 42 other districts, farmers would receive the state credit towards a debt service levy should their district voters approve bonded debt.

In 42 other districts, farmers would receive the state credit towards a debt service levy should their district voters approve bonded debt.

Only 23 districts are unaffected by AgSchool because they have little or no ag or timber land.

View list of property eligible for Ag2School 40 percent credit

The Ag2School 40 percent credit is an open and standing appropriations from the state general fund from state income, sales, and general property taxes. Learn more

Importance of Facilities and Bonded Debt

It is clear that education achieves better outcomes when students and teachers have quality facilities. Yet 50 percent of Minnesota’s school buildings were built before 1976, prior to the digital revolution. Learn more

One measure of a community’s willingness to invest in their children is the level of bond payments they are willing and able to support. The Minnesota average bond payments per pupil (APU2) is $1.081 and is fairly well balanced between the metro average of $1,147 and the rural average of $1,001.

Ag2School and DSE provide on a per pupil basis nearly five times the state support for rural pupils as compared with metro students. This reflects the lower property values per pupil in exurban areas surrounding the Twin Cities and the distribution of ag and timber lands in rural Minnesota.

| State Average | Per Pupil State/Local Shares | ||

| Statewide and Regional Summaries | Debt Payments per Pupil | State share of Debt Payments per pupil | Local Property Tax Share of Debt Payments per Pupil |

| Statewide | $ 1,081 | $ 65.18 | $1,015.73 |

| Metro (7 County metro plus districts >7,500 pupils) |

$ 1,147 | $ 20.86 | $1,125.88 |

| Rural (Greater MN districts <7,500 pupils) |

$ 1,001 | $ 116.43 | $ 884.51 |

The nearly random pattern of debt service payments per pupil reinforces how local are decisions on school facilities in Minnesota.

For homeowners and business owners in 300 school districts, 100 percent of the tax burden is theirs alone. There is no state share. This puts a heavy burden on ability to pay and clearly affects voter approval of bond referendums. Learn more.

For homeowners and business owners in 300 school districts, 100 percent of the tax burden is theirs alone. There is no state share. This puts a heavy burden on ability to pay and clearly affects voter approval of bond referendums. Learn more.

View district run of School Bond Payments, DSE and Ag2School.

Voter approved General Obligation (GO) bonds are the largest reason for school debt, but by no means the only form of school debts. School boards now have multiple instruments to bond against future revenue, some of which are voter approved, some of which not.

Ag2School is designed as a credit for all school debt regardless of the reason for the bond payments. That is one reason it affects farmers in 277 districts. DSE is limited not only because the DSE factors are not indexed to inflation, but because it affects only voter approved GO bonds.

This is a lesson for future efforts to increase the state share of bond payments. Focus on the total debt payments, not the reason for the debt payments when designing methods to increase the state share of school bond payments.