Both the Minnesota House and Senate include Operating Referendum Tax Rate reductions in their omnibus bills that are currently moving forward at the Capitol. Now is the time for school districts to begin planning, especially given the increased reliance on Operating Referendum revenue since 2003 because inflation has outpaced state aid for public schools.

Providing high quality education to every students regardless of zip code, requires increasing the state share of the local residents’ tax effort through equalization.

The proposals in each of the bodies are quite different in their effects. Through the omnibus tax bill SF 5, the Senate seeks to increase the equalization factor for each of the tiers:

- Tier 1 from $880,000 to $900,000

- Tier 2 from $510,000 to $550,000

- Tier 3 from $290,000 to $440,000

Through the omnibus education bill HF 2400, the House aims to increase the Tier 2 equalization factor from $550,000 to $650,000 while leaving Tier 1 and Tier 3 where they are.

How does each impact your school district?

At a Glance – MREA Comparison Analysis by District

House (HF 2400) – District Run

Current Tax Rates

Operating Referendum Tax Rates are dependent on the operating revenue allowance per pupil authorized by the voters of a school district (or by the school board up to $300 per pupil) and the Referendum Market Value (RMV) of the school district.

Operating Referendum Tax Rates are dependent on the operating revenue allowance per pupil authorized by the voters of a school district (or by the school board up to $300 per pupil) and the Referendum Market Value (RMV) of the school district.

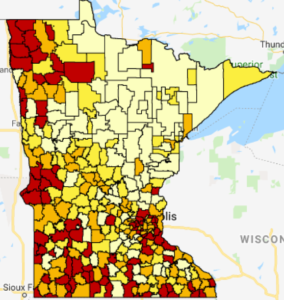

Higher allowances and lower RMVs result in higher tax rates. This has led to many of the highest tax rates occurring in Greater Minnesota school districts, as illustrated by the map to the right. Those highlighted in red have the highest tax rates in the state, based on the current law, followed by those in orange.

View FY ’19 Operating Referendum Revenue per Pupil

View Map of Referendum Market Value per Pupil

Senate Proposal

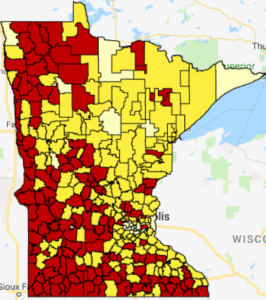

The Senate plan (SF 5) with its largest increase in the Tier 3 equalization factor ($290,000 to $440,000) achieves Senate Tax Chair Roger Chamberlain’s stated goal to reduce the highest operating referendum tax rates significantly. Fifty rural school districts would see a 20 percent or more reduction in their tax rates, as shown in red in the map to the right.

The Senate plan (SF 5) with its largest increase in the Tier 3 equalization factor ($290,000 to $440,000) achieves Senate Tax Chair Roger Chamberlain’s stated goal to reduce the highest operating referendum tax rates significantly. Fifty rural school districts would see a 20 percent or more reduction in their tax rates, as shown in red in the map to the right.

By affecting all three equalization factors, SF 5 reduces taxes in 307 school districts. SF 5 reduces operating referendums by $15 million statewide. Only those highlighted in the lightest yellow would not be affected.

SF 5 is a skinny version of SF 670, which invested $25 million in a similar manner. Learn more

House Proposal

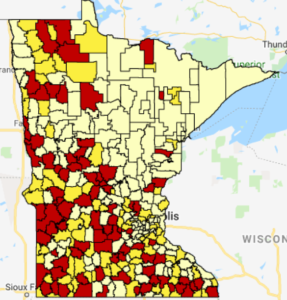

The House plan (HF 2400) concentrates its tax rate reduction to Tier 2, which it increases from $510,000 to $650,000.

The House plan (HF 2400) concentrates its tax rate reduction to Tier 2, which it increases from $510,000 to $650,000.

In doing so it affects 174 school districts, representing about half the districts in the state, as shown in the interactive map to the right. Those highlighted in red would see the highest reductions in tax rates, while those in the lightest yellow would not see a tax reduction.

Looking Forward

Increasing the state share of local residents’ tax effort through operating referendum equalization is needed to ensure students receive a high quality education, regardless of their zip code.

A shift in state funding has made school districts increasing reliant on Operating Referendum revenue since 2003 to provide education to the state’s students.

- Under SF 5: 136 school districts gain access to Tier 3 equalization with the increase to $440,000 per pupil. This means 176 school districts would receive a state share of the operating referendum tax burden up to 25% of the formula, $1,579 per pupil.

- Under HF 2400: 54 school districts gain access to Tier 2 equalization with the increase to $650,000 per pupil for a total of 276 school districts statewide. Tier 2 equalization provides a state share up to $760 per pupil.

Given the higher passage rates for operating referendums in non-Presidential elections, school district leaders need to forecast their revenue and expenditures. If a referendum is in your district’s future in 2019 or 2021, these proposed reductions in Operating Referendum tax rates through increases in the equalizing factors will be very helpful to your efforts with your residents. Be sure to work with your financial advisor and don’t wait until the dust settles at the legislature. See list of financial ddvisors

Resources

MREA Comparison Analysis by District

House (HF 2400) – District Run