Local Operating Revenue (LOR) and voter approved operating referendum revenue have become increasingly necessary and…

How much did each school district receive in ESSER funds? What is the per pupil amount? What can districts spend their funds on? How is the amount determined?

How has school operating revenue changed statewide? What’s the impact of Local Optional Revenue and Board Authorized Referendum Revenue?

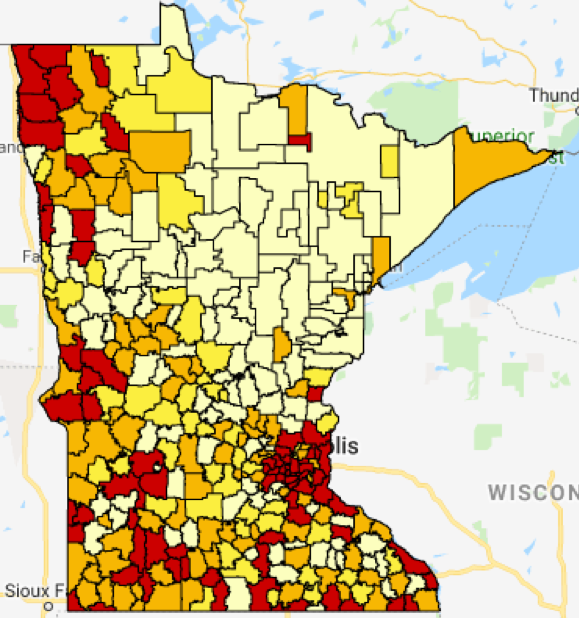

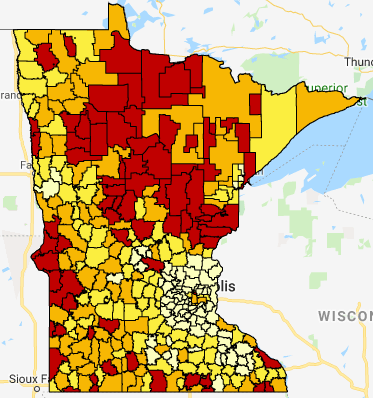

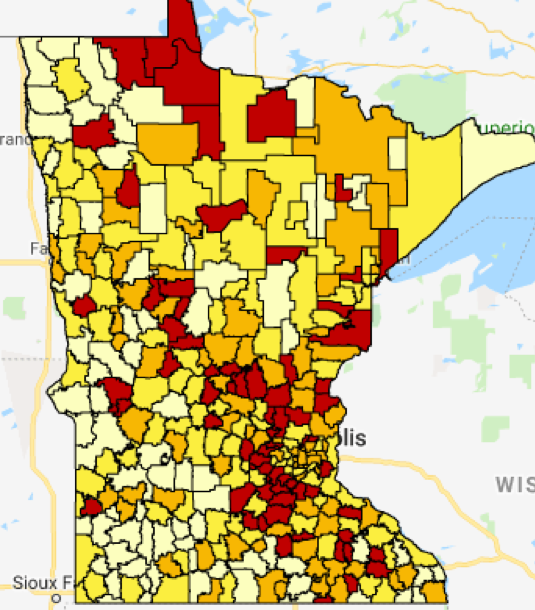

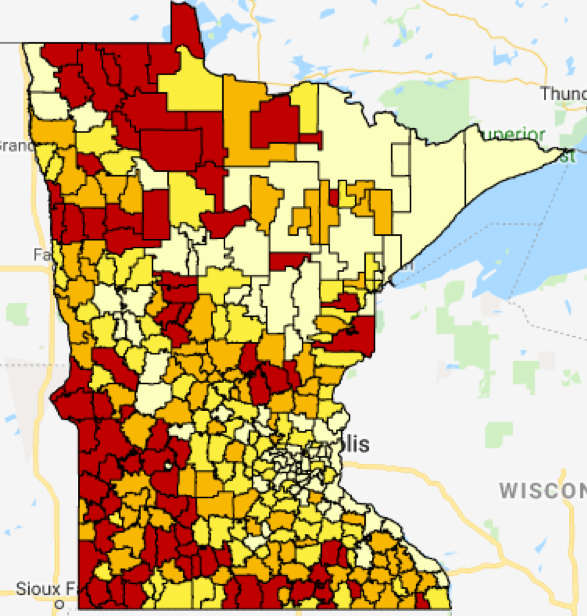

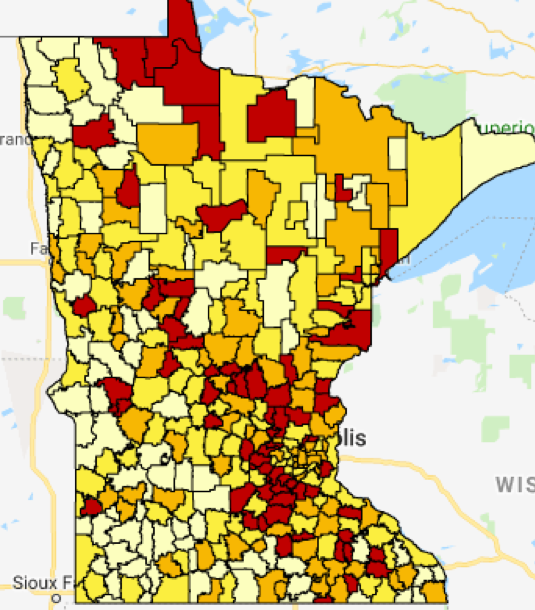

Patterns in Referendum Market Value by Residential Pupil Units as a measure of Minnesota school district property wealth in 2021.

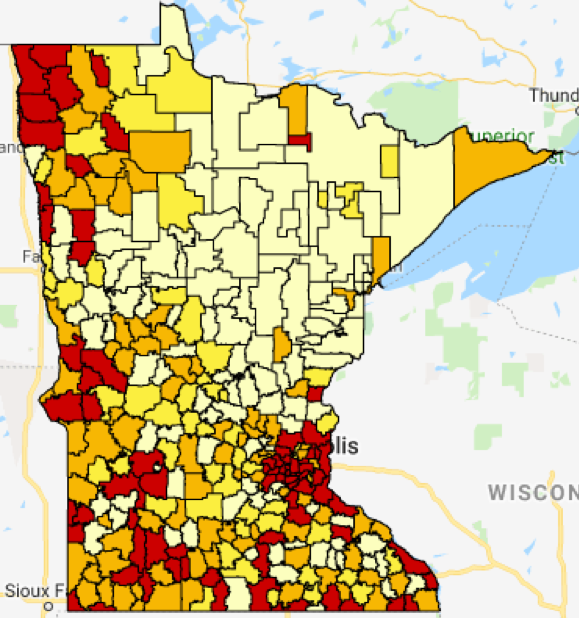

There’s a wide rural-metro divide with the state’s wealthiest district’s median income more than five times the amount of the poorest district.

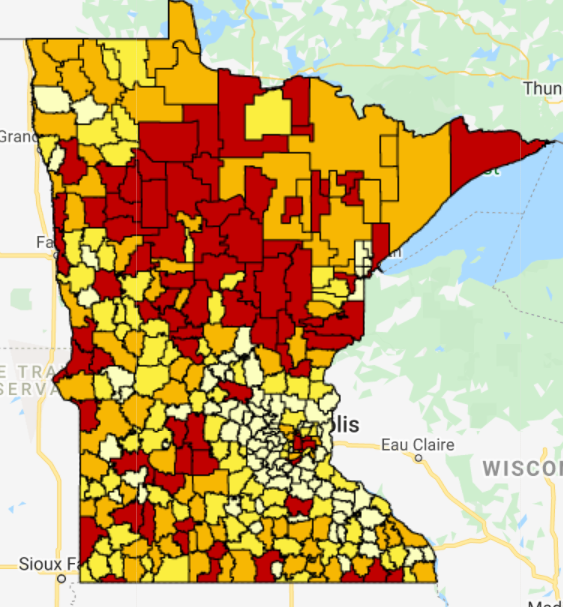

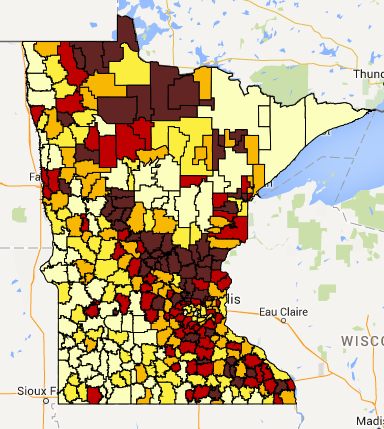

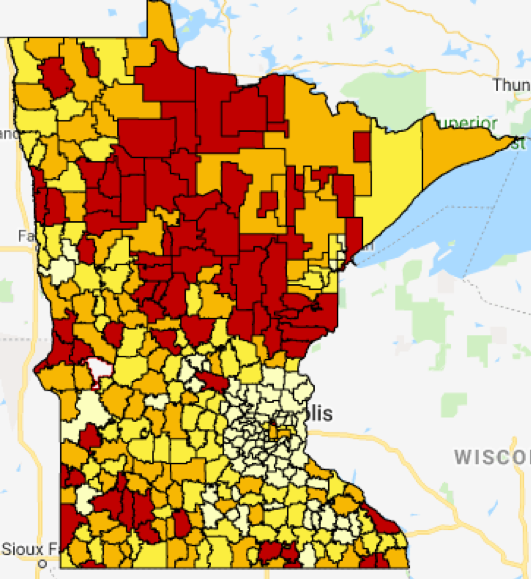

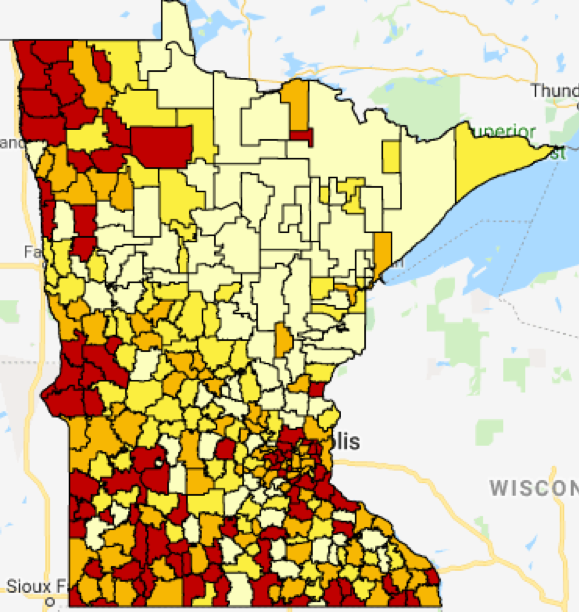

Family income and child poverty in Minnesota’s school districts by means of free and reduced lunch meals. Fifteen Greater Minnesota school districts have FRE percentages of 67 percent or more.

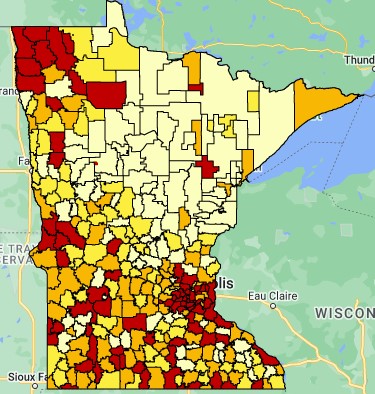

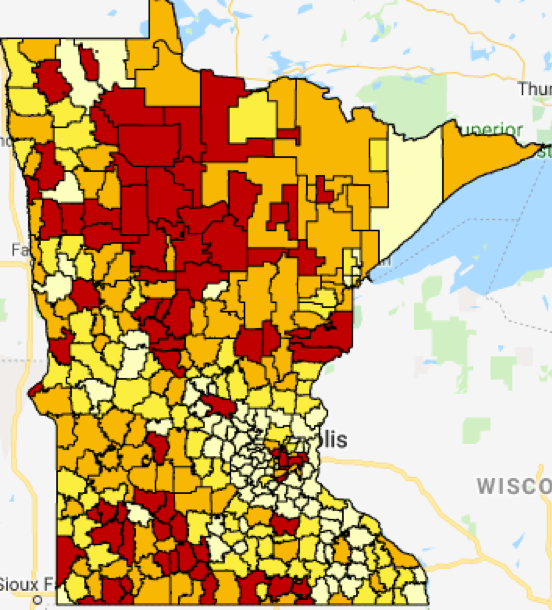

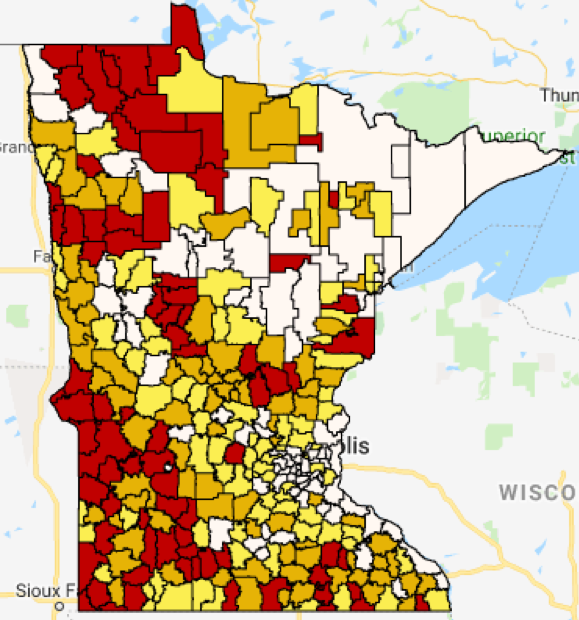

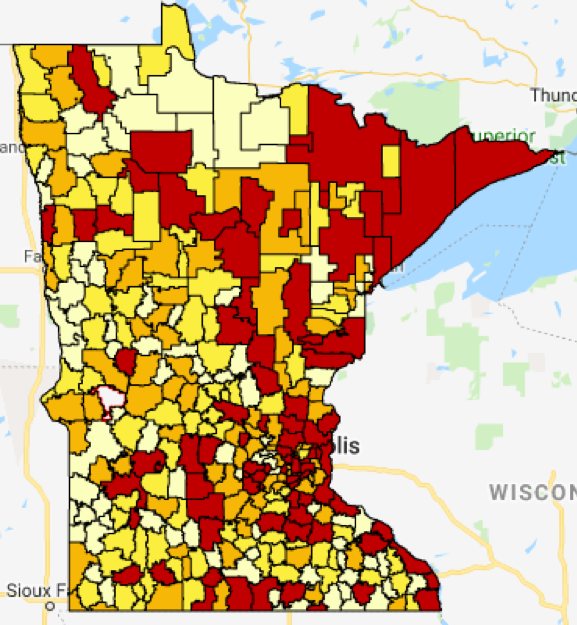

Patterns in ANTC/APU as a measure of Minnesota school district property wealth in 2017.

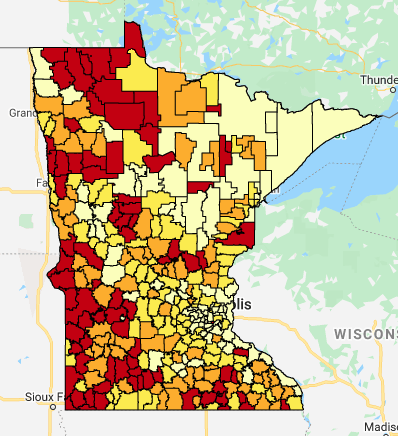

Local Operating Revenue (LOR) and voter approved operating referendum revenue have become increasingly necessary and…

Minnesota’s large amount of agriculture and timber land has impacted the funding schools receive from…

Minnesota faces a large and pervasive household income gap between rural and metro areas that…

Minnesota faces an increasing rural-metro disparity in local Referendum Market Value (property wealth1) per pupil…

MREA released an interactive map today that reveals a growing statewide dependence of school districts…

The 2019 Legislative Special Session made three property tax changes that impact school finances. Minnesota…

Both the Minnesota House and Senate include Operating Referendum Tax Rate reductions in their omnibus…

Both Minnesota Gov. Tim Walz and Education Commissioner Mary Cathryn Ricker have spoken of their…

House Tax Chair Paul Marquart has brought forth a bill to increase the Ag2School Bond…

Minnesota’s new Ag2School 40 percent tax credit has nearly tripled the state share of school…