In past legislative sessions, MREA has noticed many rural legislators are hesitant to put money into the Basic Formula Allowance because they think the funding streams tied to the Basic Formula favor Twin Cites metro-area schools. In reality, adding money on the formula helps all schools, and different funding streams affect metro and Greater Minnesota schools differently.

Four Funding Streams Tied to Basic Formula

- Declining Enrollment Revenue

- Compensatory Revenue

- Sparsity Transportation

- Sparsity Revenue

Part II: Compensatory Revenue

Earlier this month, MREA published Part I of this series, exploring how Declining Enrollment Revenue is impacted by the Basic Formula Allowance.

Compensatory Revenue is another funding source linked to the Basic Formula Allowance. Today, MREA explores the historical perspective on this funding source and breaks down how it affects each individual Minnesota district.

History

The current statute on compensatory revenue was originally passed by the state legislature in 1987. Compensatory education revenue, along with English Learner Revenue is collectively called “basic skills revenue.” When basic skills revenue initially passed, there were only seven approved uses for the funding. Currently, compensatory revenue can be used for the following:

- Direct instructional services under assurance of mastery program,

- Remedial instruction in reading, language arts, mathematics, or other content areas, or study skills to improve the achievement level of these learners

- Additional teachers and teacher aides,

- Provide a longer school day or week during regular school year or summer program,

- Comprehensive and ongoing staff development,

- Instructional materials/digital learning/technology appropriate for meeting the individual needs of these learners,

- Programs to reduce truancy, encourage completion of high school and provide a safe and secure learning environment,

- Bilingual programs, bicultural programs, and programs for English learners,

- All-day kindergarten,

- Early education programs for 4 year old’s and other outreach efforts designed to prepare children for kindergarten.

- Extended school day and extended school year programs,

- Substantial parent involvement in developing and implementing remedial education or intervention plans for a learner.

Definition

The main purpose of Minnesota’s compensatory education revenue is to help meet the educational needs of students who are under-prepared to learn and whose progress toward meeting state or local performance standards is below the level that is appropriate for their age.

The State of Minnesota uses a district’s free or reduced-price meal program count to qualify students as being eligible to receive this compensatory revenue. Parents in Minnesota voluntarily fill out forms to verify that a student is eligible for free or reduced-price meals. Students can also be directly certified if they qualify for SNAP or if they are Medicaid-eligible.

The formula is often referred to as a “concentration formula.” As the concentration of students eligible for free or reduced-price meals increases, as does the compensatory revenue per compensatory pupil.

Compensatory revenue makes up a significant portion of the General Education Revenue. In previous years, compensatory revenue made up about seven percent of the total general education revenue a district receives.

MREA’s Compensatory Loss/Gain Map and article published in October 2021 gives background on what compensatory can be spent on and the amount of money districts lost or gained in FY22 vs. FY21.

The topic of compensatory revenue has been especially pertinent the last two years because the federal government has been reimbursing districts so that all students received free meals. Now that this free meal program has ended, we anticipate districts will struggle to get parents back into the habit of paying for meals and/or filling out the appropriate paperwork needed for compensatory aid. Districts are expected to feel the impact in FY23, since compensatory revenue is based off the previous year’s free and reduced-price meal count and parents were not incentivized to fill out the paperwork last year due to the Federal reimbursement of all student lunches.

Calculation and Allocation

Almost all school districts and charter schools in Minnesota are eligible to receive compensatory education revenue. Certain other educational organizations, such as intermediate districts and educational cooperatives, are also eligible. Compensatory revenue is provided as part of the general education formula to school sites based on the number of students at the site eligible for free or reduced-price meals.

School districts generally allocate the revenue to the school site where the qualifying students attend. However, a school district may allocate up to half of its compensatory revenue to any of its school sites according to a plan adopted by the school board. This authority gives school districts flexibility to use part of their compensatory revenue for students at any grade level or in any building, including pre-kindergarten students.

Eligibility for free and reduced-price meals is set by the federal government at 130 percent and 185 percent of the federal poverty guidelines, respectively (for FY22, these percentages limited yearly income for a family of four to not more than $34,450 and $49,025). The compensatory pupil count is conducted during the fall at each school site.

The formula that generates compensatory revenue is a concentration formula based on each school building’s count of students that are eligible for free or reduced-price meals from the previous year.

- Compensatory Pupil Units = (Free Lunch Students + (.5 x Reduced Lunch Students) ) x the lesser of: (1) one; or (2) (free lunch students + (.5 x reduced lunch students)/building ADM)/.8

- Compensatory Revenue = (Basic Formula Allowance – $839) x .6 x Compensatory Pupil Units

Impact on Minnesota Districts

All districts (with the exception of Franconia and Prinsburg which do not have physical buildings) are eligible to receive compensatory revenue.

Since each building site in a district generates their own compensatory revenue, the amount of money generated at each site can vary greatly, even though they’re in the same district. For example, in FY22 Duluth East generated $69 per enrollee whereas Duluth Myers-Wilkins generated $2,921 per enrollee. The state average in FY22 was $545 per enrollee.

For the past decade, the state-wide numbers show that of the students who qualify for compensatory, approximately 75 percent qualify for free meals, while the remaining 25 percent of the students qualify for reduced meals.

MREA produced a map to show the anticipated compensatory aid for Minnesota districts in FY23. MREA uses median numbers instead of average, and this map does not factor in building sites, but uses total compensatory dollars allocated per district.

View the MREA Compensatory Aid Map for FY23

The map shows pockets of districts with high compensatory revenue like Northern Minnesota, the very southern region of Minnesota, and Minneapolis/St. Paul inner city districts. Conversely, most of the suburbs around the Twin City Metro receive very little compensatory revenue. Minnetonka is expected to receive $5 per pupil on the low end, whereas Pine Point is expected to receive $3,373 per pupil on the high end in FY23.

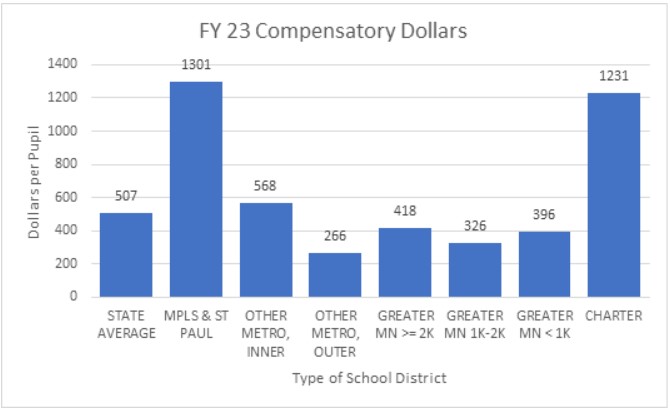

The graph above shows the expected dollars per pupil for school districts in FY23 broken out by district type. Minneapolis and St. Paul are expected to receive over three times that of any rural district. This means that Minneapolis and St. Paul schools have higher amounts or concentrations of students who qualify for free and reduced-meals.

Compensatory revenue is tied to the Basic Formula Allowance, so as the formula allowance goes up so does the compensatory revenue per district. Many feel compensatory is underfunded because it is based off school districts collecting income forms from families, but not all families submit the forms.

MREA will continue to explore the differences and disparities in rural versus metro funding through increases in the Basic Formula Allowance. Earlier this month, we explored Declining Enrollment Revenue, and in a few weeks, we’ll dig in to Transportation Sparsity Revenue.