While the legislature took a major step forward in 2015 to assist rural districts with long term maintenance needs, most rural districts face major hurdles to building new or remodeling old facilities due to tax base issues related to agricultural production land values.

In addition to facility maintenance, construction and remodeling costs, rural district leaders have cited improving school technology as their highest area of need in relation to facilities considerations. View printer-friendly brief on this issue.

Where We Stand

Bond elections are increasingly difficult to pass in rural Minnesota. In the first six months of 2015 100% of metro issues passed, while only 42% of rural issues passed (excluding one-day bonds)

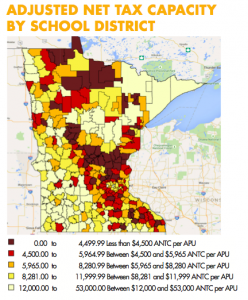

Bond elections are increasingly difficult to pass in rural Minnesota. In the first six months of 2015 100% of metro issues passed, while only 42% of rural issues passed (excluding one-day bonds)- Increased Adjusted Net Tax Capacity (ANTC) equalization is not distributed equally across the state, as shown in the map to the right 42% of districts will not see any equalization at $8,281 and farmland would be called upon to pick up much of the tab.

- Agriculture land values greatly impact ANTC. 20% of districts have at least 75% of ANTC wealth in agriculture land and one-third have 50% of ANTC wealth in ag land.

- There is a huge gap in median household incomes by district in the state with 43% difference between rural and the 7-county area.

What’s Next?

The MDE School Facilities Task Force report outlined a series of recommendations. Several bills have been introduced and are eligible for the 2016 session that would address the Facility Fallout. MREA along with farm organizations Farm Bureau and Farmers Union are active on these issues.

Concepts and Bills Introduced:

- Increase Debt Service Equalization to 125% of ANTC. SF 490 (Dahle)/HF 784 (Norton)

- 50% credit to farmers for school bond taxes paid each year. HF 848 (Davids)

- Limits to increases in ag land taxes in the first year of a school bond issue. SF 826 (Skoe)

- Ag2School bond credit program paid with state aid and a general levy on all agricultural production land.

- SF 1995 (Dahle)/HF 2122 (Kiel)

Bills also have been introduced for capital projects, leases, consolidating districts, operating capital, and Telecommunications Equity Aid (TEA). View of list of bills introduced on this issue.

Fairer State Share

Minnesota has set a goal is to educate the 21st Century’s World’s Best Workforce. That will require 21st Century learning environments, yet 50 percent of our school facilities were built before 1976, prior to the digital revolution. In 288 school districts, local property taxpayers pay 100 percent of new or remodeled facilities. MREA released an issue report outlining the challenges and need for a Fairer State Share.

Learn more and download about the report.

Additional Resources

Ag2School Long-Term Facility Maintenance Revenue (March 2015)

Effects of Facility Working Group Recommendation #2 on School Districts