In past legislative sessions, MREA has noticed many rural legislators are hesitant to put money into the Basic Formula Allowance because they think the funding streams tied to the Basic Formula favor Twin Cites metro-area schools. In reality, adding money on the formula helps all schools, and different funding streams affect metro and Greater Minnesota schools differently.

Four Funding Streams Tied to Basic Formula

- Declining Enrollment Revenue

- Compensatory Revenue

- Transportation Sparsity Revenue

- Sparsity Revenue

Part V: How does a 1% increase on the Basic Formula Allowance affect districts?

In the past two months, MREA has explored how the four main funding streams tied to the Basic Formula Allowance affect districts differently. If you haven’t read the articles leading us here, take a look:

- Part I: Declining Enrollment Revenue

- Part II: Compensatory Revenue

- Part III: Transportation Sparsity Revenue

- Ready Part IV: Sparsity Revenue

Today, we’re diving in to how a 1% increase on the Basic Formula allowance affects districts throughout Minnesota.

Define Basic Formula Allowance (BFA)

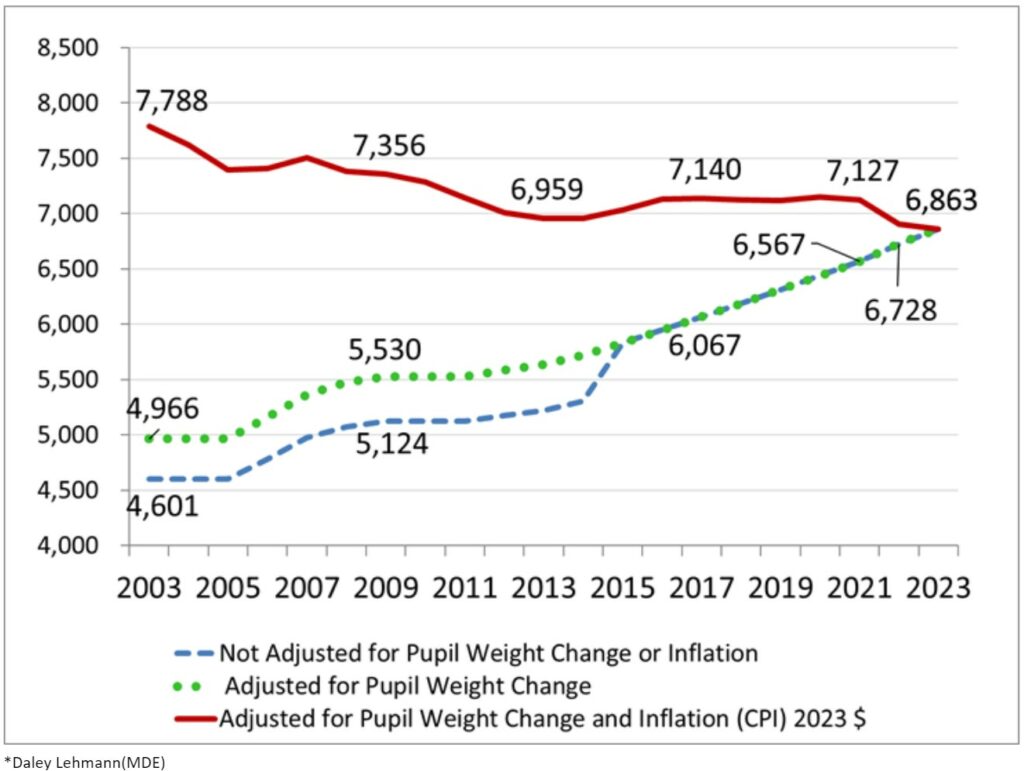

According to the House of Representatives Fiscal Analysis Department, the basic general education formula establishes the minimum level of funding for school districts. Basic general education aid is determined by multiplying the formula allowance by adjusted pupil units. The basic formula allowance is set for each year in legislation. For FY 2023, the basic formula allowance is $6,863 per adjusted pupil unit.

Minnesota school districts and charter schools will receive roughly $6.5 billion in basic formula allowance revenue in FY 2023.

Over the years, the basic formula has been increasing in dollar value (blue dotted line), but it has not kept up with inflation (red line). The graph above shows how inflation has eroded the value of the basic formula allowance since 2003. In real dollars, school districts have lost over 13 percent ($925 per pupil) on one their biggest funding streams over the last 20 years. This is the single biggest decline in education funding in relation to CPI-adjusted inflation.

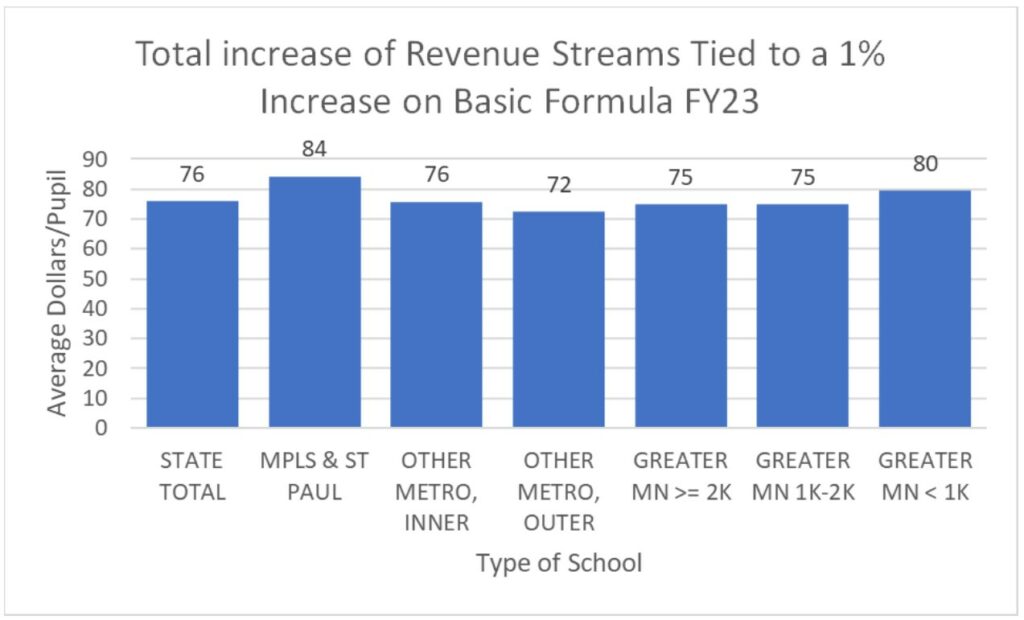

In the previous articles we explored how four different revenue streams (Compensatory, Declining Enrollment, Sparsity Transportation, and Sparsity) are tied to the basic formula allowance and how they affect each district in FY23. In FY23, a basic formula allowance increase of one percent would equate to an additional $69 per pupil for each district in the state.

MREA developed a map on how a one percent increase in basic formula allowance looks when you add all the funding streams that are attached to it MNREA Maps (mreavoice.org). MREA uses median district numbers in its maps.

Compensatory, Sparsity, and Sparsity Transportation were the revenue streams that helped put many of our rural districts in the upper quartile for dollars received per pupil. Minneapolis and St. Paul are in the upper quartile mainly because of compensatory dollars they receive. There’s a pattern of the districts surrounding the cities and a trail going down the southeast side of the state that fall in the lower quartile of revenue per pupil from a one percent increase. Of the 332 districts on the map, only five districts from the seven-county metro area qualify to be in the top quartile, including Minneapolis and St. Paul. Small rural schools do well because of compensatory, but they also have sparsity and sparsity transportation revenue which helps them greatly. Declining enrollment helps all 174 districts who lost pupils.

The graph above uses statewide average data instead of median district data. Using this analysis, we see that “Minneapolis & St. Paul” receive the highest per pupil amounts on average. “Greater MN districts with <1,000 pupils” also show an above average revenue, with the “Other Metro, Outer” lagging behind on average dollars per pupil.

| Percent of Total State $’s for 1% increase | Percentage of Students in the State | |

| MPLS & ST PAUL | 8.1% | 7.3% |

| OTHER METRO, INNER | 9.9% | 10.0% |

| OTHER METRO, OUTER | 29.3% | 30.8% |

| GREATER MN >= 2K | 22.8% | 23.2% |

| GREATER MN 1K-2K | 9.4% | 9.5% |

| GREATER MN < 1K | 10.7% | 10.2% |

The table above breaks the numbers down into percentages.

Every district in the state benefits by $69 per pupil with a one percent raise on the Basic Formula Allowance. Minneapolis/St. Paul and Greater MN districts with less than 1,000 pupils see a greater increase when the other revenue streams tied to the basic formula allowance are factored in.

“Other Metro, Outer” districts receive the least amount when looking at the percentage of students they have verses the money they receive. Three districts (Minnetonka, Wayzata, and St. Michael-Albertville) receive the minimum of $69 per pupil and do not receive any additional revenue from the four funding streams attached to the basic formula allowance.

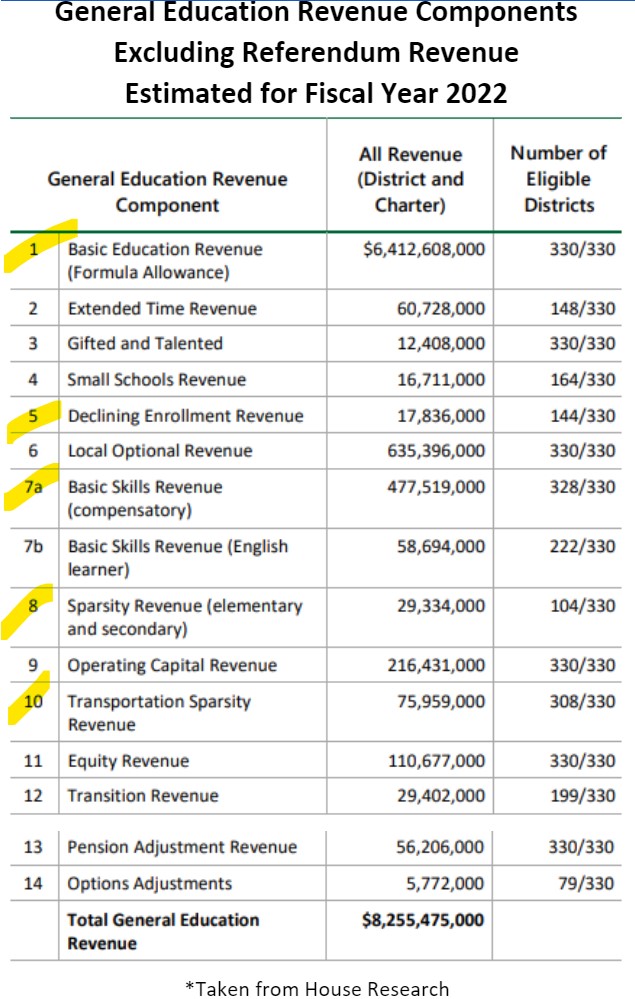

There are 14 revenue streams that make up a public school’s General Education Revenue (excluding Referendum Revenue). The basic formula allowance is by far the greatest revenue stream at $6.41 Billion in FY22. It made up 77.7% of the total general education revenue in FY22 (excluding Referendum Revenue). The numbers show the next greatest revenue stream tied to BFA is Compensatory at $477,519,000, or 5.8%, of General Education Revenue. The remaining revenue streams tied to the Basic Formula Allowance are each less than 1% of the General Education Revenue. Sparsity Transportation is .9%, Sparsity Revenue is .4%, and Declining Enrollment revenue is .2%.

So, is the Basic Formula Allowance Equitable (4 streams)?

To determine if there is equity in the basic formula allowance and the funding streams tied to it, let’s look at why districts receive extra revenue streams:

- Compensatory is revenue for districts that have low-income students who are typically more expensive to educate.

- Sparsity and Sparsity transportation is meant to offset extra costs related to running districts with low student populations and extra costs of transporting long distances.

- Declining enrollment revenue is meant to soften the blow for districts experiencing loss of pupils.

The purpose of the different revenue streams tied to the basic formula allowance is to create equity for districts that need extra revenue for their unique circumstances.

Increases in the basic formula allowance benefits all districts and is needed in this next legislative session to combat the rising costs due to inflation. Some argue that because the basic formula allowance has eroded in buying power over the last 20 years, it needs a significant increase. While it is true that Minneapolis and St. Paul receive an above average increase when looking at 1% increase on the basic formula allowance and all the revenue streams tied to it, many of our rural schools also get an above average amount of money per pupil as well. A strong argument could be made that the distribution of dollars is equitable on a 1% raise of the basic formula allowance, considering what the different funding streams target.

The Great Inequity

This series of articles is specific to what happens with a 1% increase in the basic formula allowance and revenues tied to it. We did not dive into the reliance of districts on operating referendums, which many believe has become a necessity because of the basic formula allowance not keeping up with inflation.

MREA will continue to work to identify disparities between greater Minnesota school districts and metro school districts, with an intent of helping narrow the difference.