MREA Executive Director Bob Indihar testified in the House Education Finance Committee and Senate Education Finance Committee March 6 regarding the need to improve Long Term Facilities Maintenance Revenue.

Click play on the video below to watch Indihar’s 8-minute testimony or watch the full Committee meeting here.

OVERVIEW

HF3558 and SF4305 are the latest set of bills to narrow the inequity of the difference in districts to maintain their buildings between the biggest 28 districts (Alternative Facility Districts) and the rest of the state districts.

These bills would add roofs to the approved projects over $100,000 that districts can use their LTFM dollars for. Districts can already use LTFM for Asbestos removal, indoor air quality and Fire alarm and suppression projects over $100,000.

Under the proposed legislation, districts would be able to levy for their approved roof projects without going out for a vote, and it would not count towards their $380/APU cap. This would free up money for districts to use LTFM revenue for other maintenance issues. One potential drawback is that these projects over $100,000 do not qualify for equalization that the $380/APU capped revenue does.

BACKGROUND

Alternative Facilities Bonding and Levy Program

To qualify for the Alternative Facilities Revenue, districts need to meet the following criteria:

- More than 66 students per grade.

- Over 1,850,000 sq ft. of space and an average age of building space over 15 years old or 1.5 million sq. ft and an average age of building space is 35 years or older.

- Insufficient funds from projected health and safety revenue and capital facilities revenue to meet the requirements for deferred maintenance.

- 10-year facility plan approved by the commissioner.

When the Alternative Facility Revenue bill passed back in 1993, the 25 districts (at the time) who qualified, were able to levy and bond for their maintenance needs without a cap or going to their voters.

Until 2017, the rest of Minnesota districts were unable to levy for their building maintenance needs beyond Health and Safety and Deferred Maintenance. In 2015, legislation was passed MS 123B.595 allowing all districts to levy dollars for Long Term Facility Maintenance. This legislation rolled in the old Health and Safety revenue with the Deferred Maintenance revenue, but it also allowed districts to levy and bond for maintenance needs at $193/APU. By 2019, this amount had increased to $380/APU. Since then, the non-Alternative Facility districts have been stuck at the cap of $380/APU.

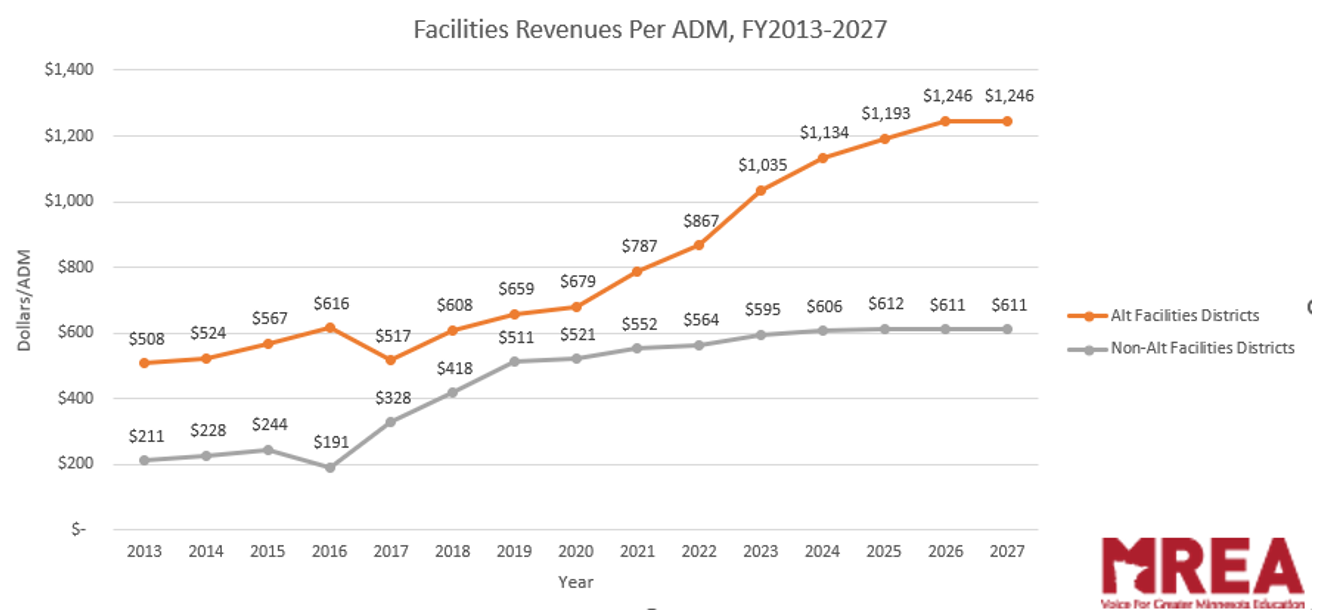

The chart below shows the effect that capping LTFM revenue has had on most of the districts (non-Alternative Facility districts) in the state. The graph shows clearly that the Alternative Facilities districts have had an increased need for dollars to maintain their buildings while the rest of the state’s districts have been capped.

All district buildings, no matter size or location, wear out in a similar fashion. MREA’s position is that it is not fair that 28 of the biggest districts in the state can have an uncapped safety blanket of levying and bonding for their maintenance issues while the rest of the state needs to go to their voters or take money out of their general fund to pay for their maintenance needs above the capped $380/APU factor, which is clearly not keeping up with inflation.

MREA IS ADVOCATING FOR THE LEGISLATURE TO:

- Add “roof repair and replacement, sidewalks, and parking lots,” to the list of projects qualifying for costs over $100,000.

- Extend the current LTFMR equalization factor to the projects that qualify over $100,000. This will help ensure property taxpayer fairness for these larger deferred maintenance projects.

- Increase the basic LTFM allowance and index it to an inflationary factor, and eventually lifting any cap on the revenue.

MORE INFORMATION ABOUT MREA’S LTFM POSITION