House Tax Chair Paul Marquart has brought forth a bill to increase the Ag2School Bond Credit to 100 percent.

“2% of Americans live on farms, but ag land averages 34 percent of Minnesota school districts’ tax base,” he said as he introduced HF1391 on Monday to the House Property Tax Division. Sen. Kent Eken is the author of the bill in the Senate, SF1512.

Lindsey Leach, Dillworth-Glyndon-Felton School Board member and Neal Rockstad, a farmer in the Ada-Borup school district, provided compelling testimony on the need. Rockstad testified that his farm paid more in property taxes than the Walmart Superstore on Highway 10 in Dilworth.

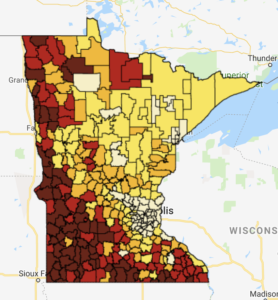

He’s not alone. Agriculture land represents a significant percentage of property value for school bonds across Greater Minnesota, as illustrated in the map to the right. Districts highlighted in the red have between 40 percent and 70 percent of their district wealth coming from ag land or private timber. The percentages of those highlighted in the darkest red exceed that.

He’s not alone. Agriculture land represents a significant percentage of property value for school bonds across Greater Minnesota, as illustrated in the map to the right. Districts highlighted in the red have between 40 percent and 70 percent of their district wealth coming from ag land or private timber. The percentages of those highlighted in the darkest red exceed that.

View interactive map to see your district’s number.

The Ag2School 40 percent credit for school bonds was an MREA signature effort in 2017 and provides tax relief across Greater Minnesota to agriculture land and private timber land property.

Cost to Increase

Moving from a 40 percent credit to 100 percent would cost $66.8 million to start in FY ’21 and grow to $109 million by FY ’23 , according to the Department of Revenue. This is based on an assumption that “if the credit increase is enacted, levies eligible for the credit are assumed to increase compared to the current law forecast.”

Given that Marquart is the Chief Author of HF1391, there is good expectation that some form of this increase, possibly 60-80 percent, will be in the tax bill that the House takes to the conference committee this spring.

View Video Listen to Audio Testimony on HF 1391 begins one hour into the hearing.