MREA connected with both the state E-12 and Tax Committees as they prepare for final negotiations to highlight the unique needs of rural education and solutions needed to provide our state’s students with key educational opportunities. MREA pointed to specific provisions to advance in each of the respective areas to set school districts and educational cooperatives up for student success and to provide farmers and homeowners tax fairness.

MREA encourages you to reach out to your legislators now to advocate for students. MREA provides an overview of the key needs and facts below. Find your legislators.

Adequate Funding

Rural schools and their students are highly dependent on state aid. Rural schools lag metro schools by an average of $683 per pupil in combined Operating Referendum Revenue and Local Optional Revenue. Rural schools lack the tax base and household incomes to make up that difference.

As a result, MREA asks that you include this funding in the final E-12 conference committee report:

- Rural schools are highly dependent on the formula and 3% and 2% matters greatly

- Rural schools with School Readiness Plus (SR+) need state funding to continue to offer this opportunity in their communities

- Rural schools with high Special Education cross subsidies need to have the cross subsidies frozen and even reduced with cross subsidy reduction aid in the House Bill

Increase Ag Bond Credit to 70%

The House bill contains language increasing the Ag Bond Credit to 70%. This increase would immediately lower the current bond taxes on farmers and private timber owners in 287 school districts with bonded facility debt. In today’s difficult ag economy, this will make a difference in the operating margins of farmers and assist the whole rural economy.

We’re hopeful the legislature can increase the Ag Bond Credit started in 2017 during this time of economic distress for farmers.

Reduce Highest Operating Referendum Tax Rates

The Senate bill contains language to increase all three Tiers of the Operating Referendum equalization with the greatest increase in Tier 3.

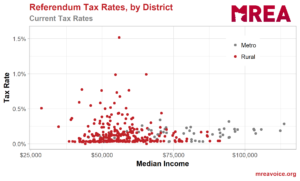

Statewide, households comprise 65 percent of the Referendum Market Value (RMV), and in rural districts that percent is just shy of 70 percent. The resulting current distribution of operating referendum tax rates reveals a distinct ‘L’ pattern of many rural districts with lower median incomes having much higher tax rates than any metro district.

The Senate language addresses this directly by dramatically increasing Tier 3 equalization and reduces these higher tax rates considerably.

Given the increasing reliance on local operating referendum revenue as the State struggles to fund the education formula at or above inflation, we’re hopeful the legislature can build on the Senate’s good start to create more equal tax efforts to raise similar operating referendum revenue for students’ education regardless of zip code.

Cooperative Facilities for High Need Students

The House bill contains language from HF 1980 (SF 1999) giving school districts more tools to address the deferred needs of their cooperative facilities. Rural schools utilize cooperatives to provide specialized instruction and facilities for high need students whereas metro schools utilized the Intermediate districts. The House bill provides cooperatives with comparable support that Intermediate district members can provide through lease levy and LTFM authority.

Initiated in 2017, we’re hopeful the Legislature can provide the needed tools these provisions provide rural cooperatives.

CE Credentialing

The Senate bill eliminates current year funding for this innovative collaboration between Lakes Country Service Cooperative and MN State Moorhead. The NWP is helping high school teachers attain the graduate credits they need to continue teaching concurrent enrollment college courses in the high school setting.

The House bill would extend the NWP funds into the next biennium, allowing them to expend these funds for two more fiscal years. The Higher Learning Commission (HLC) has indicated they will be back in 2022 to review the status of concurrent enrollment staff credentials. Continuing this program will help our faculty members meet their requirements and retain concurrent courses with post-secondary credits for students.