Part III: Compensatory Education Revenue

High Schools’ Rocket Ride up the Compensatory Revenue Roller Coaster FY23 – FY24

How did this rollercoaster of great decline and even greater rebound occur? Is it sustainable? What other changes have been made to Compensatory revenue?

MREA is digging into compensatory revenue with a four-article series:

- The Great Decline from 2021 to 2023 (Dec 7, 2023 article)

- The even Greater Rebound 2023 to 2024 (Jan 8, 2024 article)

- The effects on site revenue (this article) , and

- The transition to all Direct Certification and the sustainability of this level of funding (Feb 5).

Changes on the Compensatory Reserve Expenditure Requirements Enacted in 2023

The legislature has significant control over the uses because Compensatory Revenue is a reserve and used only for specific purposes—as opposed the formula allowance which districts allocate to meet any number of educational costs. In the 2023 legislature session, two significant changes were made to how the Compensatory Revenue can be expended:

- Increased the Compensatory Revenue reserved to be expended at the site where it was generated from 50% to 80%.

- Reduced and Narrowed the Allowable Expenditures for Compensatory Revenue (Basic Skills Revenue)

Change 1 – Site Specific Use

Increased the Compensatory Revenue reserved to be expended at the site where it was generated from 50% to 80%.

A distinguishing feature of Compensatory Revenue is that it is computed at the building, or site level, not at the district level. For the most part, sites are intuitive. Districts have sites which are separate buildings, with a principal such as elementary P-6 and secondary 7-12, or with a middle school. But when districts, coops or charters establish alternative schools, area learning schools, on-line schools, early learning centers, these too become sites. In the 23-24 school year, there are 2,385 sites in Minnesota, some of which have as few as one student.

The legislature establishes how much of the Compensatory Revenue raised at any given site must be reserved to be expended at that site. Prior to FY24, that percentage was 50%. Many rural districts focused the majority of their Compensatory Revenue in their elementary grades to get students off to the best start possible and have as many students proficient in reading and math by third grade as possible.

MREA does not believe the 2023 legislators deliberately set about to raise the Compensatory Revenue to be reserved for secondary students, but rather intended to reserve it for elementary schools with higher poverty in districts in multiple elementary schools. But high schools are sites, and this may be one unintended effect of the change from a 50% reserve to 80%. Since the vast majority of MREA’s 237 member districts have only one elementary and one secondary school, this is major shift in Compensatory Revenue from elementary to high schools. Because of this shift, we’re diving in on the increases to secondary schools today.

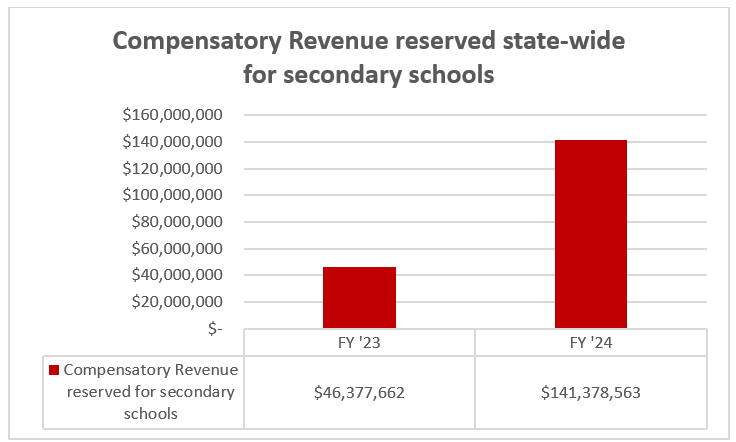

In the Great Rebound, (Jan 8, 2024 article) there was a chart showing a 79.1% increase in statewide Compensatory Revenue from FY’23 to FY ’24. Add the change from 50% to 80% in revenue that must be expended at the site generated, or reserved, for secondary schools statewide, you get an increase of just over $95 million, or 205% for 363 high schools or secondary schools as can be seen in the chart below. These are the schools where students put on team uniforms and play for school and community pride.

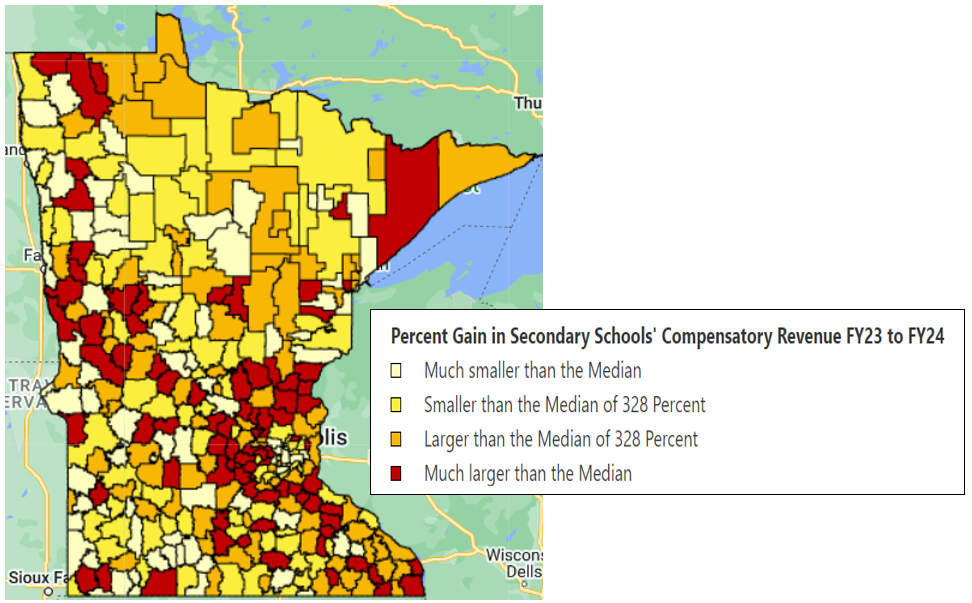

The median districts’ secondary school(s) growth in Compensatory reserved revenue for districts’ secondary school(s) from FY23 to FY24 is 328%. The map below shows the distribution. Find your district’s secondary school(s) Compensatory reserved secondary school(s) revenue. Note: these are ‘flagship’ high school(s), it does not include ALCs, alternative or online high schools.

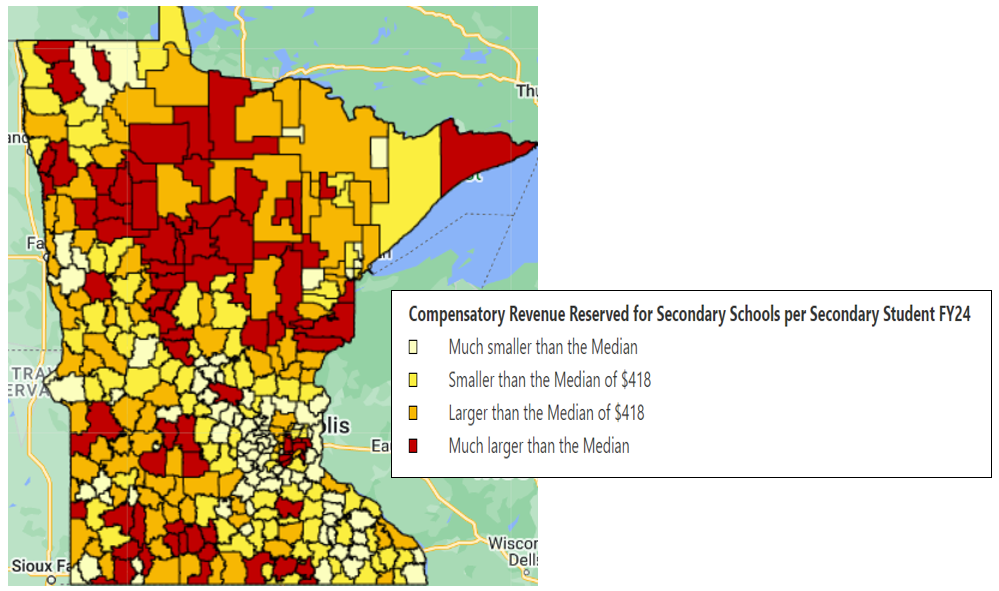

Another way to look at this is to ask, “How much per enrolled pupil in districts’ secondary school(s) must be reserved for Compensatory Revenue allowable uses.” The median per district is $418 per pupil. The distribution can be seen in the map below. Find your district’s Compensatory reserve per secondary student.

For these maps, districts with multiple high schools were combined into one total per district.

For FY23 to FY24 increases in Compensatory Revenue reserved for each flagship secondary school, see this MREA table.

The second change from the 2023 legislative session reduced and narrowed the allowable expenditures.

Change 2: Reduced and Narrowed Allowable Expenditures

Reduced and Narrowed the Allowable Expenditures for Compensatory Revenue (Basic Skills Revenue)

Compensatory Revenue funds are a component of Basic Skills Revenue and “…must be reserved and used to meet the educational needs of pupils who enroll under-prepared to learn and whose progress toward meeting state or local content and performance standards is below the level that is appropriate for learners of their age.” (MN Statute 126C.15, Subd 1 (a))

For FY24 and beyond, the legislature reduced the allowable expenditures from twelve to nine and narrowed some of the remaining.

For example:

- Prior to FY24, school districts could expend Compensatory Revenue on the following:

– programs to reduce truancy, encourage completion of high school, enhance self-concept, provide health services, provide nutrition services, provide a safe and secure learning environment, provide coordination for pupils receiving services from other governmental agencies, provide psychological services to determine the level of social, emotional, cognitive, and intellectual development, and provide counseling services, guidance services, and social work services;Starting in FY24, allowable expenses in the same general category are limited to the following:

– programs to reduce truancy; provide counseling services, guidance services, and social work services; and provide coordination for pupils receiving services from other governmental agencies; - Prior to FY24, school districts could expend Compensatory Revenue for the following:

– instructional materials, digital learning, and technology appropriate for meeting the individual needs of these learners;

For FY24 and beyond, this list was narrowed to remedial instructional materials:

– remedial instruction and necessary materials in reading, language arts, mathematics, other content areas, or study skills to improve the achievement level of these learners;

While these changes may seem minor, they are more specific, and in the case of instructional materials, single out students who are not achieving as expected.

The reason it is more general and flexible is to lower instructor-to-learner ratios. In discussions with several superintendents and business managers about these legislative changes in Compensatory Revenue at the secondary level, this allowable purpose was always at the top of the list. As one business manager put it, “Principals always want more teachers.”

- additional teachers and teacher aides to provide more individualized instruction to these learners through individual tutoring, lower instructor-to-learner ratios, or team teaching;

Another allowable use which drew attention in some of the conversations was the following:

- programs to reduce truancy; provide counseling services, guidance services, and social work services; and provide coordination for pupils receiving services from other governmental agencies;

Use this link for a full list allowable uses prior to FY24 and for FY24 and beyond.

Reactions from Several MREA Member District Superintendents and Business Managers

A small sampling of business managers and superintendents in MREA districts came up with the following themes regarding the increases in Compensatory Revenue especially at the secondary level:

- They were thankful for the increases in funding for sure;

- They felt it was too short a notice—these superintendents and business managers found out about the change in the summer at the MDE workshops on finance after their ’23-24 budgets and staffing plans had already been determined;

- Most are still working to create plans for FY24-25 that make effective use of the funds for struggling learners that fit the “funneled down list of uses,” as one superintendent put it.

When prompted to suggest modifications, the 2024 legislature should consider to Compensatory Revenue; the top recommendations were the following:

- Consider what has happened with secondary Compensatory Revenue, because it is hard to imagine that the 2023 legislature deliberately set out to increase Compensatory Revenue to such a degree at the secondary level;

- Add allowable uses more appropriate for struggling secondary students such as school-to-work programs, CTE and apprenticeships; and

- In districts where the majority of Compensatory Revenue had been directed to the elementary, reduce the percentage retained at the secondary level, if not back to 50%, then 60 or 65%. The concern is that they may have to increase class sizes at the elementary in the future since their ability to transfer Compensatory Revenue from the secondary level has been so significantly reduced.

Key Take Aways

- For Minnesota’s 363 ‘flagship’ high schools, Compensatory Revenue reserved for secondary schools increased $95 million or 205% from FY23 to FY24, due both to the increase in Compensatory Revenue due to direct certification with Medicaid (Jan 8, 2024 article) and the change from 50% to 80% in revenue that must be reserved to be expended at the site it was generated.

- The median increase in districts’ secondary school(s) Compensatory Revenue required to be reserved and expended at the secondary site was 328%.

- The funding is most welcome, but the short notice and especially the restrictions on allowable uses, create difficulties for districts to effectively apply these greatly increased secondary Compensatory Revenues.

For the FY23 to FY24 increases in Compensatory Revenue reserved for each flagship secondary school, see this MREA table.

What’s Next?

Are these increases Compensatory sustainable beyond FY25? MREA will examine FY25 Compensatory Revenue with MDE data to look for trends that can be extrapolated to FY26 and beyond in the February 5 Insider Brief.